Enhancing Consumer Experiences

With one in every two consumers willing to change their behavior and visit a different gas station for a better experience, fueling and convenience retailers risk losing market share if they don’t have a strong grasp on the customer journey. What is the current experience for visitors? Are they meeting consumers’ top priorities — experience fundamentals like physical safety, amenities, payment security and loyalty programs? If so, gas station owners who want to gain an edge can look beyond the basics to appeal to emerging consumer preferences, such as self-service solutions, advanced payment technologies and smart, customized experiences at the pump.

But as with any new technologies or innovations, retailers should avoid an “implement it and forget it” mentality. Our research illustrates that consumers value reliability, ease of use, speed and convenience when it comes to fueling and c-store experiences, so any new solution needs to work seamlessly and consistently. That doesn’t necessarily mean full automation. Friendly and helpful interaction with staff is still in demand among consumers, which creates opportunities for retailers to combine top-quality customer service with enhanced experiences to grow customer loyalty and earn new fans.

It’s no surprise that price and location are critical to a consumer’s choice in fuel station, but these findings illustrate the need for owners to differentiate themselves with customer experience. Half of your competitor’s customers are willing to jump ship. There is opportunity to gain an edge by offering a stand-out experience, whether that’s through your customer service, facilities, technologies, food and drink, amenities — the list goes on."

Vice President & General Manager, North America, Dover Fueling Solutions

Consumers prioritize practicality when deciding where to fill up, considering fuel price, location and fuel quality. But they’re also factoring the quality of their experience into the equation. DFS found that 50% of consumers would switch to a competitor gas station if it offered a significantly enhanced experience.

This number jumps even higher among millennial consumers, with 60% willing to pursue a better experience. In fact, consumers under 34 are less concerned about location when choosing their gas station, with 48% viewing it as a top-three factor compared to

66% of consumers over 34. Together, these findings could indicate

a willingness among younger consumers to drive farther for

high-quality service.

There’s no shortage of ways to create a better fueling experience.

As a starting point, retailers can look to the fourth and fifth most important factors consumers consider when choosing a fueling station — physical safety and amenities, such as convenience stores, car washes, air stations, restrooms and ATMs. In open responses, consumers also cited cleanliness, easy access, friendly staff and a wide selection of food and drinks as factors they look for in a great gas station experience.

Half of consumers would switch gas stations for a better experience.

The Impact of Experience

Evolving Consumer

Behavior and Preference

Excellent fueling experiences are no longer a "nice to have"

for retailers, with 50% of consumers willing to switch gas stations if offered a significantly better experience.

DFS is a leading global provider of advanced customer-focused technologies, services and solutions in the fuel and convenience retail industries. Through a portfolio of products that includes fuel dispensers, EV chargers, tank gauging, fleet management and retail automation, DFS is empowering the evolution of the consumer experience in fueling and convenience retail.

Methodology: In July 2023, DFS surveyed 1,003 consumers to better understand what they’re looking for from their fueling experiences, including themes such as convenience, service, technology, amenities and customization. All respondents were based in the U.S. and represented a sample that reflects U.S. census data in terms of age and gender identity.

Approach: The report is organized into five key consumer trends that surfaced in the survey results. With each trend, subject-matter experts from DFS, Key Oil Company, Jump Start Stores and GRUBBRR provide perspectives and advice for fueling and convenience retailers on how to approach and improve the customer experience.

Gas prices and consumer spending continue to fluctuate, and the competition for brand preference and loyalty among fueling and convenience retailers is fierce. As consumers heighten their expectations for top-notch retail experiences, especially among younger generations, the fueling industry will have to keep pace.

But is innovation what consumers want? Dover Fueling Solutions (DFS) set out to determine the experiences consumers are looking for from gas stations and convenience stores and the capabilities and services that will win over new customers and retain frequent fuelers.

The survey results illustrate consumers’ current behavior at the pump and draw distinctions between their reality and their preferred experience. The findings also outline what informs their decision on where to get gas and how they envision technology improving gas stations. With this insight in hand, fuel station owners can evaluate

the experience they deliver to customers based on what makes the biggest impact from the forecourt to the c-store.

The Future of Fueling Report:

Innovation at the Pump

2023

Kendra Keller

For the second year, payment security and speed were the two features consumers valued most when making gas station purchases. Both categories increased year-over-year, indicating even greater consumer consensus.

Consumers are also looking for greater control of their payment experience. The top two technology features consumers want at fueling stations are the ability to pre-pay for a specific amount at the pump (47%) and the option to split a fuel payment on multiple credit cards (24%).

With these concerns in mind, fuel station owners have a significant opportunity to ease payment concerns, educate on payment security protocols and implement the latest payment and security technologies, such as contactless and EMV card readers and point-to-point encryption.

Payment remains a top factor in consumer fueling experiences.

Growing Payment

Security Concerns

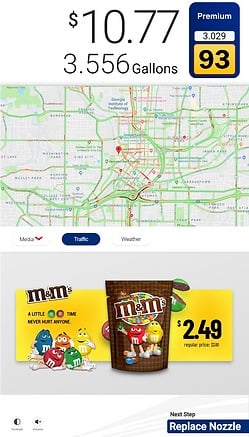

DFS found that more than half (51%) of consumers "always" or "often" notice advertisements on or around a fuel pump, but consumers have mixed opinions on their effectiveness. Close to one-third (32%) say fuel pump commercials or ads have convinced them to enter a convenience store, with age also playing a factor in that decision.

Gen Z and millennial consumers are more likely to be swayed to go into a c-store based on ads at the pump, and nearly half of them (46%) say those ads influenced their purchasing decision.

Outside of ads and commercials at the pump — which can be divisive among consumers — there is ample opportunity for gas stations to engage or entertain customers while they top off their tanks. In fact, consumers are even more interested in viewing weather forecasts (50%), loyalty program information (45%), and traffic reports (41%) than store offers or promotions (40%).

Ads at the pump are catching the attention of younger consumers, driving c-store foot traffic.

From Dispenser Media

to the C-Store

Self-service technology has boomed since the COVID-19 pandemic, especially in quick-service restaurant environments where consumers

now expect speed and convenience. DFS explored whether consumers would similarly embrace self-ordering at the pump and in gas stations, where they often want an “in and out” experience.

While 42% of all consumers say they are likely to use self-ordering technology for their c-store food and drink purchases, Gen Z (57%) and millennial (59%) consumers are much keener to do so than

Gen Xers (45%) or baby boomers (30%). Those who wouldn’t want

to self-order cite losing the human element as the biggest reason — they prefer interacting with staff.

Based on consumer feedback, gas station owners can convince more of their customers to self-order if they integrate loyalty programs or rewards, provide special promotions and discounts, or offer a wider variety of food and drinks.

And if self-ordering technology makes its way out to the pump, consumers say they’d use it if it meant saving time (45%), increasing convenience (43%) and gaining access to special offers (40%).

What would they order? Cold beverages, snacks and candy,

and freshly brewed coffee topped the list. These are also some of

the most profitable items for convenience retailers, indicating that order from the pump could be a win-win. Snacks and refreshments are also the strongest force pulling consumers into a c-store.

Younger consumers are eyeing self-ordering technology to get their snack and drink fix.

Perceptions of

Self-Service Solutions

DFS asked respondents to peer into a crystal ball and envision how technology or innovation might improve their fueling experience in the future. As it turns out, consumers aren’t picturing an unrealistic technology overhaul at gas stations — simply an improvement on their current experiences. Productivity at the pump, speed, ease and accessibility were common themes.

Consumers view the time they spend refueling as an opportunity

to multitask, imagining technologies like on-demand TV, car maintenance "report cards," and c-store ordering systems.

They also see innovation potential in the speed of their gas station visits, with suggested improvements focused on quicker payments and faster-flowing fuel. Many consumers envision greater convenience while refueling, such as having options for an email or text receipt, a more automated fueling process, and smart pumps that know their preferences without asking. Finally, some consumers believe technology can support gas station features that suit a wider

variety of individuals, abilities and needs.

Consumers are ready to multitask while refueling — if it’s fast and user friendly.

Future Fueling Predictions

83%

Price of Fuel

Top Factors Considered

When Choosing a Gas Station

61%

Location

43%

Fuel Quality

18%

Amenities Available

Gen Z

47%

Millennials

60%

Gen X

59%

Baby Boomers

43%

Director of Marketing & Brand Management, Jump Start Stores

Kristin Ghere

To improve and customize the fueling experience for consumers, I’d advise retailers to figure out who your customer is and super-serve that target segment. Too often, we try to be everything to everyone. Define what makes you unique in the space and focus on that. Chart out your customer journey and identify the friction points that need to be addressed."

79%

Payment security

70%

73%

66%

63%

58%

52%

45%

49%

51%

Fast payments

Loyalty programs

Touch screen terminals

Pay for store items and fuel

*percentages indicate those who selected "value a lot" and "value a great deal"

2023

2022

2023

2022

2023

2022

2023

2022

2023

2022

Brand & Marketing Director,

Key Oil Company

Keelye Gaither

The best way to prevent fraud is to be proactive in your forecourt. When wiping down dispensers every day, make sure everything is intact and check the security seal. Additionally, owners should make sure their Point-of-Sale software and hardware are always up to date. This is your safety net."

Senior Director, Product Management, Dover Fueling Solutions

Scott Negley

Protecting customers’ payment data at the pump should be a top priority for fueling retailers, since it’s clearly top of mind for consumers. There is nothing more frustrating than having to cancel credit or debit cards due to fraud, and retailers risk losing loyal fuelers if their gas station is perceived as a risk. First, ensure you’ve covered basic security protocol: change passwords frequently, make sure security jumper switches are removed from inside the pump and update to the latest code. Then, I’d recommend investing in a data security solution with point-to-point encryption, so you know you’re protected by the industry standard for security."

Gen Z

46%

Millennials

42%

Gen X

33%

Baby Boomers

23%

Convinced by Fuel Pump Ads to Enter the C-store

51%

of consumers "always" or "often" notice advertisements displayed on or around a fuel pump.

Baby Boomers

25%

Gen X

38%

Millennials

46%

Gen Z

46%

Brand & Marketing Director,

Key Oil Company

Keelye Gaither

My biggest piece of advice for gas station owners looking to improve their customer experience is always to pay attention to what your customers are saying. And the number one complaint customers have about ads at the pump is that the volume is too loud. To provide the best experience, edit your ads to ensure a consistent and reasonable volume, and stay conscious of what audio plays in the forecourt when people aren’t actively fueling. Is it chaotic or pleasant?"

Senior Product Manager,

Dover Fueling Solutions

Jen Threlkeld

Based on these findings, fueling retailers should view their dispensers as prime real estate for media. Consumers are paying attention. For owners exploring this avenue, I’d recommend striking a balance between advertising and entertainment or information, like weather and traffic reports, to hold customer attention. Then, to get the most value out of advertising at the pump, consider a strategy like dayparting, or scheduling relevant ads during different times of the day, which is more compelling for consumers than a static pump-topper."

Baby

Boomers

30%

Gen X

45%

Millennials

59%

Gen Z

57%

How likely are you to use self-ordering technology for food and beverage purchases at a fuel station?

Integration with loyalty programs or rewards

40%

Availability of special promotions or discounts for self-ordering

40%

Wide variety of food and beverage options

39%

User-friendly interface and intuitive ordering process

31%

Customization options for orders (e.g., toppings, condiments)

27%

What would make you inclined to use self-ordering technology?

Chief Revenue Officer,

GRUBBRR

Jarrett Nasca

Consumers at gas stations often expect quick service and are usually in a hurry. Retailers can address the convenience and speed expected today by integrating the shopping experience directly into the fueling process, such as allowing orders while pumping gas and informing customers via text when orders are ready. On the operations side, these technologies can help create efficiencies and higher throughput of orders. And to maintain the human element,

the key is to focus on providing great customer service while fulfilling orders."

VP Global Business Development, Key Accounts, Marcom, Dover Fueling Solutions

Kurt Dillen

Consumers are clearly open to different self-service technologies at fuel stations, which sets the stage for a lot of unique and valuable partnerships in the space. With collaborations between the fuel and convenience retail industry and cutting-edge technology providers,

fuel station owners can look to deliver faster, more convenient experiences for their customers."

For more information on DFS and its solutions, visit doverfuelingsolutions.com.

Learn more about the future of fueling and convenience experiences

of consumers are "somewhat likely" or "very likely" to switch fuel stations if a competitor offered a significantly enhanced customer experience.

50%

What features do you value most when making purchases at a convenience store/gas station?*

(Click the icons below to explore further)

Providing language options or options for deaf people."

It would be nice to have the option to adjust the lighting on the pump screen. Sometimes it is hard to see the numbers."

Definitely a volume button for the screens at the pump. Most are way too loud."

Allowing all types of card or cash payments to be used, rather than only a few types of cards & always having to go inside for cash payments."

More Accessible

Automated fuel delivery, to be able to fill up without getting out of the vehicle."

I love the idea of a pump already knowing my preferred gas preferences and cash back options across multiple chains."

Making the pump more user friendly, making the CC

scanner instructions more clear."

I like the idea of receiving my receipt sent to me via text."

Easier

Faster pumps that can be used to fuel the car without holding the pump handle."

The option to click a single button to activate the pump. $5, $15, or Fill Tank."

The speed at which fuel flows from the pump into your gas tank."

Pay cash at the pump instead of going inside to pay."

Faster

Access to things like air, oil, washer fluid and antifreeze from the pump as well as being able to buy items from the convenience store while pumping gas."

You can change the TV channel to shows you like to watch, like BET, VH1 or MTV."

Wi-Fi connection to the car's maintenance status to

get a 'report card' at each fuel stop, such as MPG,

oil change status, tire pressure, factory recalls."

I normally don't purchase items in the store, but I do like to be entertained while standing there pumping gas."

More Productive

Experiences will be...

(Click the titles below to explore further)

Purchasing Decisions Impacted by Fuel Pump Ads

Baby Boomers

25%

Gen X

38%

Millennials

46%

Gen Z

46%

Chart 2

Chart 1

Baby Boomers

23%

Gen X

33%

Millennials

42%

Gen Z

46%

Convinced by Fuel Pump Ads to Enter the C-store

Chart 2

Chart 1

Purchasing Decisions Impacted by Fuel Pump Ads

(Click above to toggle charts)

Purchasing Decisions Impacted by Fuel Pump Ads

Convinced by Fuel Pump Ads to Enter the C-store

(Click the icons to explore further)

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"